GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Chase is one of several financial institutions that offer cashier’s checks to their members. These checks are easy to obtain and affordable, making them a great secure payment option. Here’s a quick rundown of Chase cashier’s check fees:

Read on to learn more about Chase cashier’s checks and how they compare to other financial institutions.

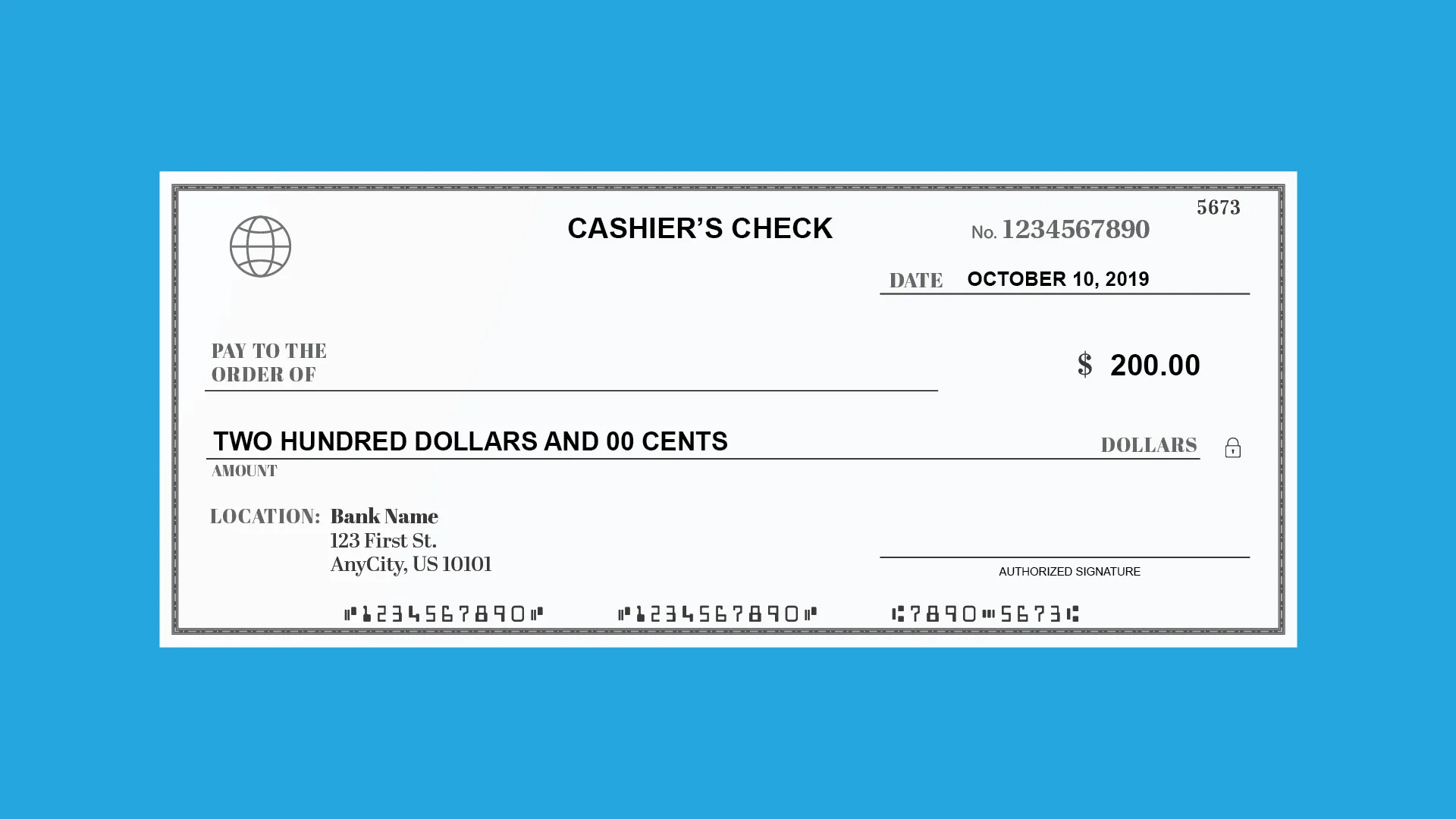

A cashier’s check — also known as an official check — is a method of payment that is considered less risky than personal checks. They’re written and backed by the bank or financial institution they’re purchased from.

The purchaser pays upfront for the cashier’s check, either with cash or through a bank account. The check is only written once the funds are made available to the bank.

The bank creates the check with the payee’s information on it and signs it. Doing so means that the bank is then guaranteeing the funds shown on the check. There’s no risk of the check bouncing, so payees know that they’ll receive their money.

It also typically means the money is available quickly and securely, making cashier’s checks great options for:

Follow these simple instructions on how to get a cashier’s check at Chase:

Get the latest news on investing, money, and more with our free newsletter.

By subscribing, you agree to our Terms of Use and Privacy Policy. Unsubscribe at any time.

You're now subscribed to our newsletter. Check your inbox for more details.

If you bank at Chase, how much you pay for a cashier’s check will depend on the type of account you have. Chase’s different types of checking accounts come with different features and fees.

For instance, you’ll pay no cashier’s check fee if you have a Premier Plus or Sapphire checking account, but you’ll pay a Chase cashier’s check fee of $10 if you have Total or Student Checking account.

If you’re a Chase customer and you need a cashier’s check to pay for a large purchase, visit your nearest branch for a fast, easy and safe way to guarantee that the funds are available.

Here’s how the fee for a Chase cashier’s check compares with most other well-known institutions.

| Institution | Cost | Fee Exceptions |

|---|---|---|

| Chase | $10 | Fee-free for Premier Plus and Sapphire Checking members |

| Wells Fargo | $10 | Fee waived for certain accounts |

| Navy Federal Credit Union | Two free cashier’s checks per day, then $5 each | N/A |

| Capital One | $10 in branch, $20 online | No |

| Bank of America, Member FDIC | $15 | Fee-free for Preferred Rewards members |

| PNC Bank | $10 | Fee waived for Virtual Wallet® with Performance Select and Foundation Checking account members |

| Ally Bank | $0 | N/A |

| U.S. Bank | $10 | Fee waived for military members |

A Chase cashier’s check can provide security and peace of mind for both the purchaser and the payee. If you need to make a large or fast payment, a Chase cashier’s check is a practical, safe and inexpensive way to do it.

Using a Chase cashier’s check ensures that no one else can cash the check except the payee. It also means there’s no chance of the check bouncing, saving you from paying a lot of late fees.

Unlike a money order, there’s no limit to the amount you can get for a cashier’s check. However, you must have the full amount of money available to cover the face value plus any applicable fees. Always check your account prior to a visit to your bank branch to ensure you have enough funds available.

Barri Segal contributed to the reporting for this article.

Information is accurate as of May 18, 2023.

The information related to Chase Products was collected by GOBankingRates and has not been reviewed or provided by the issuer of these products. Product details may vary. Please see issuer website for current information. GOBankingRates does not receive commission for these products.

Editorial Note: This content is not provided by Chase. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by Chase.